Huge increases in property taxes without locally available tools to lower them amounts to taxation without representation. Wyoming state law limits the ability of locally elected officials to reduce property taxes and backfill revenue through other taxes or fees. The fix is in the hands of the state legislature. But good ideas on how to do so go nowhere in Cheyenne. They might if we stand together as a community.

The Wyoming Constitution mandates that counties uphold the laws of the state while protecting the health and welfare of their citizens. Over the past few years property taxes in Teton county have risen 100% or more. There’s little doubt these increases are impacting the health and welfare of Teton County citizens. Long-time locals—workers who form the core of the community, educators, critical care service providers, and retirees—are facing a dire choice: pay these higher taxes and spend less on health care, day care, food, and education or sell out and leave.

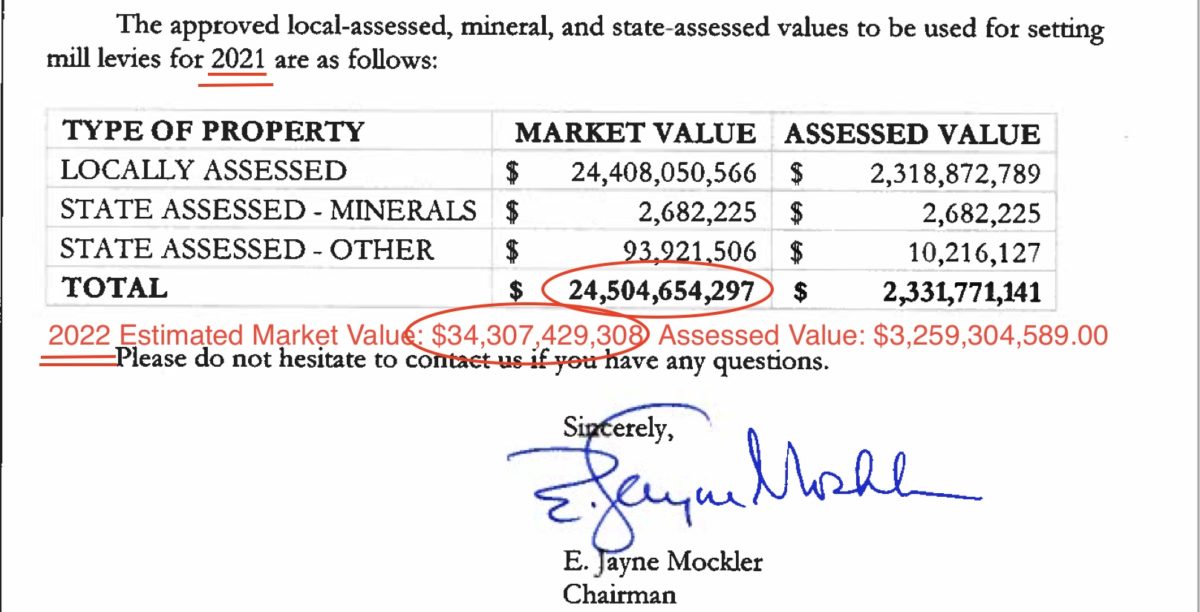

Property owners in Teton County currently pay a minimum of 57 mills (1/1000th of a dollar) of tax on the assessed value their property. Fifty-seven mills equals $57 in tax on every $1,000 of assessed value. By law, 45 of the 57 mills collected, or about 79%, is for school funding. By law, county commissioners control no more than 12 mills of the total millage. In Teton County we levy 7 of the 12 mills, amounting to 12% (7 out of 57) of the total amount you pay in property taxes. That’s the maximum amount the Teton County Board of Commissioners could reduce property taxes. Twelve percent.

If we did zero out property tax, we would lose almost $23 million in revenue out of a $91 million general fund budget. That might not be an issue except that the county is facing several critical needs. Top of the list is employee housing. Ten percent of county positions are vacant, largely due to lack of housing. Wages are also rising, and the public sector must keep up. And we need millions to replace and renovate county buildings that are aging and over-crowded. Most critically, the courthouse, built in 1968, wouldn’t withstand a modest earthquake. If it were to collapse, it would take the Sheriff’s department and 911 services housed in its basement with it. Replacing it will cost $60 to $70 million.

Over the last 6 years the county commission has cut our portion of the mill levy from just over 9 to just under 7 mills. If we continue to reduce the county mill levy, the immediate reductions in revenue might stall or delay long-awaited and essential capital improvements only to achieve a 2 or 3% reduction in tax bills that have gone up 100% or more.

Other states grant counties the power to directly reduce property taxes by implementing homestead exemptions that apply to full-time residents. Wikipedia has plenty of examples. Other states grant counties the power to make up for the resulting decrease in property tax revenue by imposing fees in other sectors of the economy such as assessing fees on sales of real estate. A 1 to 2 percent real estate transfer fee, even restricted to only those sales over $2.5 million in value, would be enough to backfill revenue losses from reduced property taxes and fund the development of workforce housing.

But the Wyoming Legislature remains steadfast in their refusal to grant us the authority to fairly apportion taxes that lessen the burden of excessive property taxes. They remain steadfast in their refusal to find alternative means of financing our excellent public school system to reduce its reliance on property tax revenues. They remain steadfast in ramming higher property taxes down the throats of locals, workers, critical service providers and retirees.

Stripping local government of an important revenue stream that would force cuts in services and scale backs to critical capital projects, only to reduce sky rocketing tax bills by a few percentage points isn’t protecting the health and welfare of county citizens. We need the kind of tools granted to counties throughout the nation that allow locally elected officials to guard against severe escalations in property taxes and still deliver vital local services.

We need to pull together and aggressively lobby state legislators for local control and an end to taxation without representation.

Thanks, Mark. This gives us some information that we can use to address the problem for those of us who are long time locals and on retirement income.

Mark,

Please take the lead in demanding from Cheyenne relief for Teton County residents. The real estate transfer tax should have been passed years ago!

Other states have a cap on the % / year that our taxes can go up. It has reached an unsustanable level. Who will be left in this valley?